Three Cost-Saving Ways Servicers are Using Workflow Automation

There’s an old saying that the first step is often the hardest. For many mortgage servicers, the idea of workflow automation sounds both appealing...

3 min read

Jane Mason : Aug 14, 2025

Mortgage assumptions are back in the spotlight. As interest rates remain elevated and homebuyers hunt for affordable financing, the ability to “assume” a seller’s lower-rate mortgage has become increasingly attractive. This trend offers buyers major savings and gives sellers a powerful tool to market their homes.

For servicers, mortgage assumptions bring a host of operational headaches, particularly around releases and fulfillment. There is good news though. Workflow automation changes the narrative. Servicers can transform assumptions from a dreaded one-off manual process into streamlined, repeatable workflow that improves compliance, cuts costs, and delivers better borrower experiences.

Despite the rising popularity of mortgage assumptions, the process is anything but smooth for most servicers. From intake to final release, bottlenecks and manual missteps create delays, compliance risks, and frustrated borrowers. Here are the pain points we see in most assumption processes.

Borrowers often submit assumption requests with incomplete packets, such as missing divorce decrees, death certificates, or powers of attorney. Servicers spend weeks chasing down missing items, and every delay risks frustrating the borrower.

Each investor has its own rules: FHA requires HUD 92210 forms, VA requires a formal credit review, and Fannie/Freddie each have nuances around release of liability. Servicers juggling these requirements manually often select the wrong form or deny a release altogether out of caution.

Once approved, the assumption requires generating agreements, disclosure packages, and release forms. Many servicers rely on manual preparation or third-party vendors with long SLAs. If the wrong investor specific form is used, the whole process resets.

After the documents are signed, releases and title updates need to be recorded. County offices may reject submissions for formatting errors or missing notarizations, causing weeks of rework. Borrowers sometimes remain liable long after they should be released.

Borrowers are often left in the dark, unsure of their status or next steps. Internally, legal, fulfillment, and customer service teams operate in silos. Status updates get lost, escalations pile up, and borrowers flood call centers with “What’s happening?” calls.

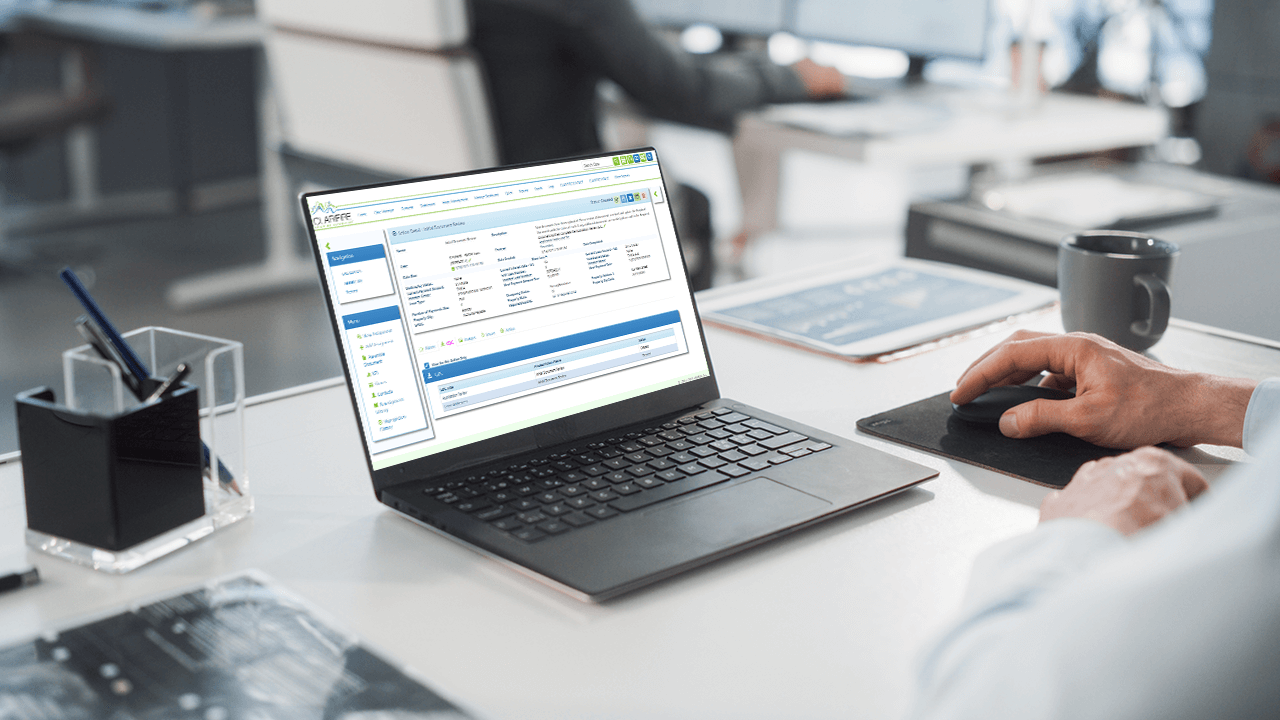

Servicers no longer have to rely on fragmented, outdated methods to process assumptions. CLARIFIRE, a workflow automation platform built for servicers, doesn’t just digitize forms, it transforms the entire assumption process from start to finish. Here’s how:

Borrowers can start the process themselves by answering eligibility questions and uploading documents through CLARIFIRE’s self-service interface. Instantly, the system triages the request, identifies the loan type (FHA, VA, conventional), and applies the right workflow path and fee logic.

No more juggling emails, spreadsheets, and sticky notes. CLARIFIRE pulls every step, credit check, investor eligibility (via Fannie Mae SMDU, Freddie Mac tools), and title review into one cohesive workflow. Actions are distributed in real time to the right team with the right data. Nothing gets lost.

With regulatory scrutiny a concern, compliance can’t be an afterthought. With CLARIFIRE, every step is tracked in one workflow from intake to release recording. Real-time dashboards flag missing signatures, unrecorded releases, or county rejections before they become compliance nightmares.

Borrowers don’t have to call. They can log in to CLARIFIRE COMMUNITY™ to see their status, understand what documentation is needed, and get notifications when the next step is ready. That means fewer calls, fewer complaints, and a better borrower experience.

When servicers switch from manual, paper-heavy assumption processes to an automated workflow, the difference isn’t just noticeable, it’s transformative. What used to take weeks of back‑and‑forth and frustrated phone calls becomes a smooth, trackable, and borrower-friendly experience. Here’s how CLARIFIRE takes the biggest pain points in mortgage assumptions and turns them into operational wins.

|

Problem |

With CLARIFIRE |

The Result |

|

Manual fee miscalculation |

Embedded business rules determine correct fee amounts based on investor guidelines. |

Reduced compliance risk, accurate fee application |

|

Missed regulatory deadlines |

Workflow triggers pause actions & alerts |

Avoids violations and fines |

|

Title, credit, investor silos |

Integrated workflows & third-party system connections |

Smooth coordination, fewer errors |

|

Angry borrower calls |

24/7 borrower status portal |

Lower call volume, higher satisfaction |

|

Release not recorded promptly |

Automated deadline reminders, alerts for missing information, and audit trails |

Timely liability releases |

|

Requirements differ by investor/agency |

One configurable, cohesive workflow |

Consistent application of investor/agency requrements |

Mortgage assumptions are not going away. If anything, demand will grow as long as interest rates remain high. Servicers face a choice: continue with a manual, error‑prone process that frustrates borrowers and risks compliance issues, or embrace automation that makes assumptions smooth, consistent, and efficient.

In a market where every efficiency matters, workflow automation isn’t just smart, it’s essential. With CLARIFIRE®, servicers can simplify every assumption, release sellers from liability correctly, and create a better experience for everyone involved. The future of mortgage assumptions doesn’t have to be painful, and with the right automation, it won’t be.

Learn how CLARIFIRE can help you take the pain out of mortgage assumptions. Schedule a demo, visit our website, or follow us on LinkedIn and X.

Jane has applied her vast experience (over 25 years) operating process-driven businesses to successfully redefine client-focused service. Jane has worked with expert programmers to apply cutting-edge web-based technology to automate complex processes in industries such as Financial Services, Healthcare and enterprise workflow. Her vision confirms Clarifire's trajectory as a successful, scaling, Software-as-a-Service (SaaS) provider. A University of South Florida graduate, Jane has received many awards related to her entrepreneurial skills.

Like this article? Feel free to share this with a friend or colleague!

There’s an old saying that the first step is often the hardest. For many mortgage servicers, the idea of workflow automation sounds both appealing...

Mortgage servicers gathered in Dallas last week for the annual MBA Servicing Solutions Conference & Expo to explore insights on what to expect in...

Exhausted by change? Every company, mortgage-based or otherwise, is experiencing a shift in automation as an essential part of business. The timing...